RightBRIDGE® Annuity Wizard is the ultimate pre-sales annuity solution for broker-dealers, seamlessly combining compliance solutions with intuitive annuity research tools.

RightBRIDGE® Annuity Wizard is the ultimate pre-sales annuity solution for broker-dealers, combining robust compliance features with intuitive product selection tools. With a focus on pre-sales suitability review, it helps you stay ahead of regulatory requirements, including Regulation Best Interest, Reasonably Available Alternatives, NAIC Best Interest Reg Model (#275), NY Reg 187, and FINRA Rule 2330 (Members’ Responsibilities Regarding Variable Annuities). With access to extensive data on all annuity types, enhanced research tools, automated best interest documentation and seamless integrations, RightBRIDGE® Annuity Wizard empowers financial professionals to confidently navigate and document the complex landscape of annuity sales and compliance.

RightBRIDGE® Annuity Wizard stands out as the pre-sales compliance and suitability review solution due to its comprehensive framework that keeps broker-dealers ahead of ever-evolving regulatory and compliance requirements. Broker-dealers can leverage automated checks based on industry standards, regulatory requirements and a firm’s list of suitability requirements. It ensures thorough compliance assessments for each transaction and automatically documents the results through ReasonText® so that the recommendation is crystal clear to reviewers, financial professionals and their clients.

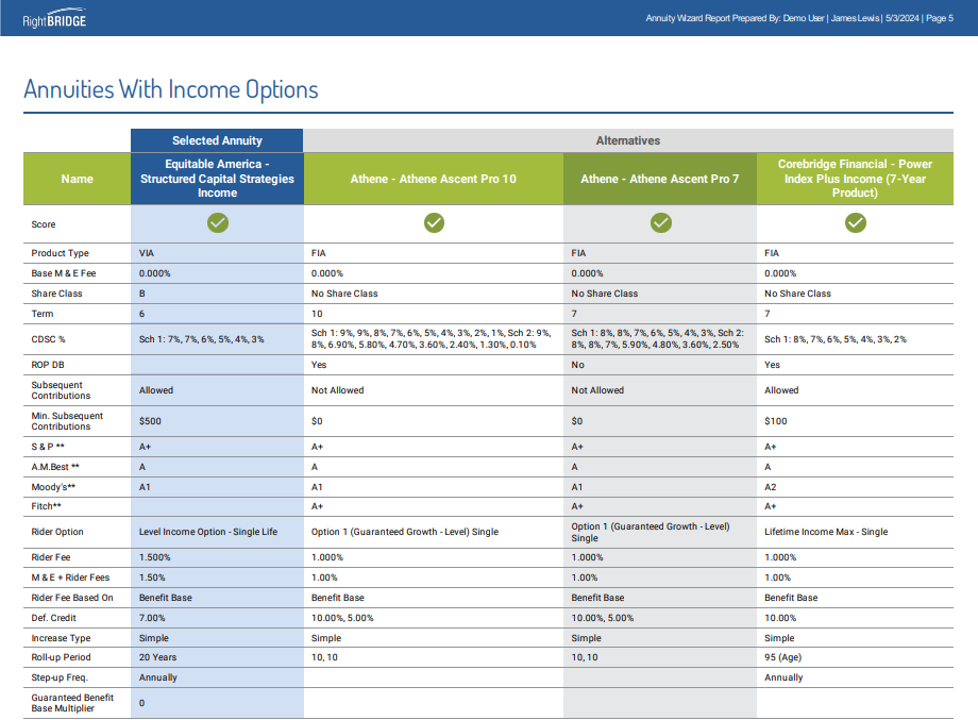

Through RightBRIDGE’s powerful rules engine, RightBRIDGE® Annuity Wizard identifies alternatives at both the annuity and rider levels, providing comprehensive assessments based on factors like the client’s preferences, investment objectives, risk tolerance, annuity features, and firm suitability rules. Reasonably Available Alternatives are selected only from the available products on a firm’s product shelf.

Side-by-side comparison and reports quickly summarize the proposed annuity and applicable alternatives. Furthermore, the inclusion of ReasonText® ensures that financial professionals can easily document and justify their selection of Reasonably Available Alternatives, enhancing transparency and compliance readiness.

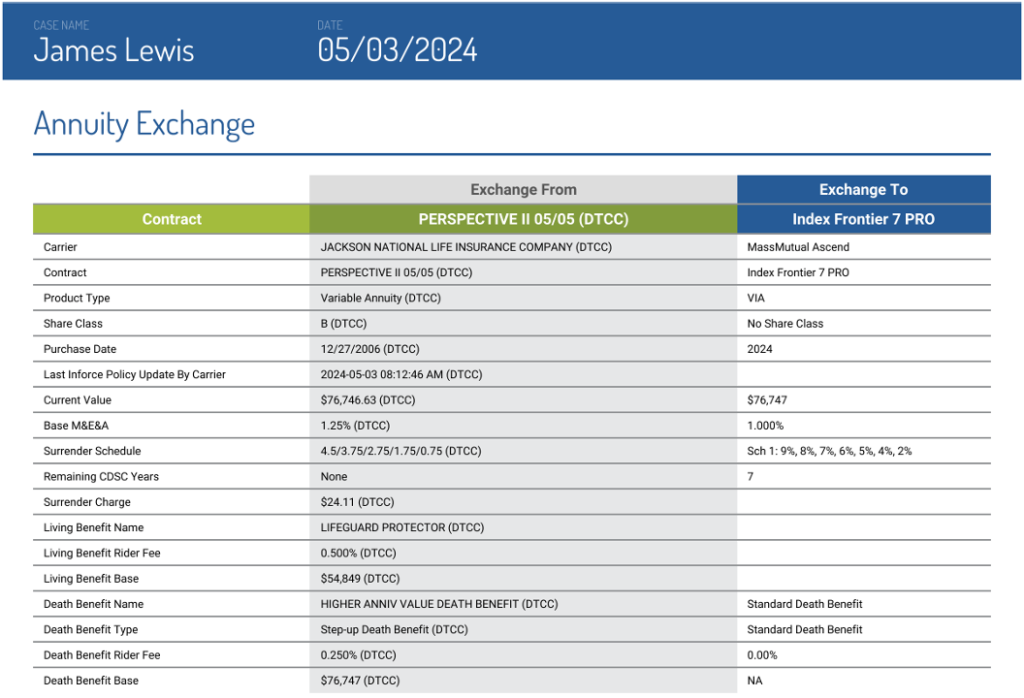

Streamline the annuity exchange review process by leveraging RightBRIDGE® Annuity Wizard’s data and rule-based engine. RightBRIDGE® Annuity Wizard can automate the bulk of a firm’s suitability review process for annuity exchanges based on configurable scoring and rules. The RightBRIDGE® Annuity Wizard offers integrations with providers such as Beacon Research for historical annuity data and DTCC for inforce policy information to create a one-click experience on populating an exchange form. RightBRIDGE® Annuity Wizard empowers users to present exchange recommendations alongside comprehensive product comparisons, facilitating clear decision-making and documentation for the exchange’s basis.

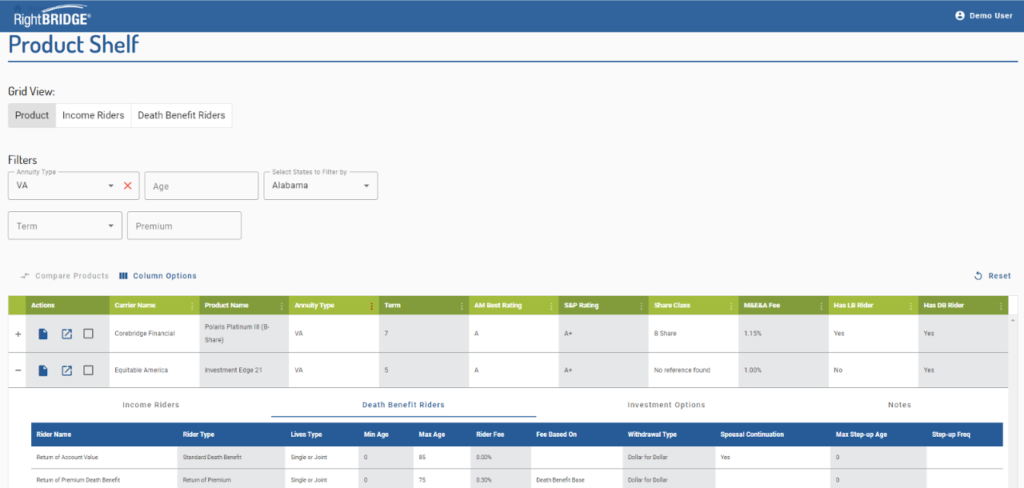

RightBRIDGE® Annuity Wizard offers enhanced product research tools that empower broker-dealers and their professionals with comprehensive insights into all annuity types. With the ability to compare details side-by-side across different products, users can make informed decisions tailored to their clients’ needs. The platform provides access to a wealth of information, including living benefit riders, death benefit riders, up-to-date rates and subaccounts.

RightBRIDGE® Annuity Wizard is a single destination for all things annuity pre-sale.

Validate whether a proposed product meets the firm’s best interest requirements.

Standardize and automate the suitability review process for annuity transactions.

Sort, filter, and compare all annuity types on your firm’s complete product shelf, across all annuity types in one place. Review products, riders, rates and subaccounts in a sortable grid or in fact sheets.

Compare a proposed exchange product with currently available products. Generate required exchange documentation.

Choose Reasonably Available Alternatives from a pre-screened list of products that are high confidence alternative products.

Integrations with order entry platforms creates a seamless user experience